Prohibition Partners LIVE - Day Three Review: Business & Investment

OVER the next three days, Prohibition Partners LIVE features a packed programme of discussion and debate featuring some of the global cannabis industry’s most informed leaders and opinion-makers.

The final day of Prohibition Partners Live was about Business and Investment with not only the movement of US firms into overseas markets – especially Europe – but also the internationalisation and globalisation of cannabis.

In his opening address to day three, Prohibition Partners’ CEO Stephen Murphy outlined the agenda and said two key topics that would be covered would be capital and the rise of celebrity brands and endorsement.

In relation to capital he said: “As the cannabis industry matures more and more, and certainly as we start seeing a new investor class come into the space, we have to adapt the conversations and how we communicate what is happening in the industry, so we are looking at where we are now seeking capital, how we can raise capital, and how companies can be best positioned to raise that capital.”

Stephen Murphy then went on to discuss the rise of the celebrity-led cannabis market, which he said was good for column inches and hitting the headlines and “is a very natural affiliation when it comes to celebrity endorsement,” but added “is it actually good for the companies bottom line, where it matters?”

Earlier in the day Barbara Pastori, Conor O’Brien, Alexander Khourdaji, Lawrence Purkiss and Baha Makarem from Prohibition Partners had hosted a live round table discussion with topics covering everything from what are the areas clients should be looking at and the opportunities, to supply chain positioning, company structure, what’s happening in Europe, and the programmes underway to allow patients access to medicinal cannabis brands.

Barbara Pastori said: “It’s really interesting to look at the market and how it has evolved because only a few years ago it wasn’t so much cultivation of medical cannabis and now, of course, there has been a huge surge in supply. It doesn’t mean there is a lot of product availability…but we have certainly noticed a shift of the margins to a more downstream segment of the supply chain.”

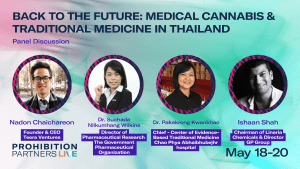

This was followed by a 35 minute pre-event networking session, before Mr Murphy’s opening address which led seamlessly into the first discussion of the day, Back to the Future – Medical Cannabis and Traditional Medicine in Thailand, on the Cannabis Oceania platform.

This saw an esteemed panel of speakers discuss the recent changes to legislation in the Asian country which has seen leaves, stalks, stems and roots removed from the narcotics list (although recreational use is still illegal) and the Thai government’s promotion of research and development into the use of medical cannabis in traditional medicine.

Moderator Nadon Chaichareon (founder and CEO of Teera Ventures) was joined by Dr Suchada Nilkumhang Wilkins (director of pharmaceutical research and development group at The Government Pharmaceutical Organization, Thailand), Ishaan Shah (chairman of Linaria Chemicals and director GP Group), and Dr Pakakrong Kwankhao (head of the Centre for Evidence-based Thai Traditional and Herbal Medicine at Chao Phya Abhaibhubejhr hospital).

Dr Pakakrong Kwankhao said: “Thai traditional medicine is our cultural identity…with the emphasis on the balance of the inner body, which is totally different from Western medicine. However, before we adopted Western medicine we used Thai traditional medicine for treatment, and that is why the Government recognised the importance and value of Thai traditional medicine.

“Right now, we are integrating Thai traditional medicine into our health system. It means that if you go to hospital in Thailand….you can choose what type of treatment you want….and for my hospital we have used herbal medicine and also Western medicine for improved quality of life for our patients.”

With the first medical cannabis batches distributed to hospitals across Thailand, Dr Nilkumhang Wilkins said: “Overall, the feedback from doctors and patients has been good. Both groups have expressed confidence in the quality of GPO’s (Government Pharmaceutical Organization) medical cannabis products.”

In relation to clinical studies underway, she added: “These studies have demonstrated that most patients responded well to treatment and that no serious side effects were found. The results of studies on effectiveness and safety in relation to various disease groups have been published.”

On the current scene in Thailand, Mr Shah said: “Everyone is aligned with the fact the farmers have to benefit…without the right quality biomass Thailand is not going to be able to scale the availability of cannabinoids, whether it be THC, CBD or any of the other minor cannabinoids, in a real meaningful way. So everyone is clear that the farmers have to win.”

He said the interesting question was the start-ups and big corporations. “Thai people, we love snacks and drinks, and I think a lot of big corporations in Thailand are makers of snacks and drinks, so I think all those big companies are suddenly looking as to how they can capitalise on not just the cannabinoids, but functional beverages and foods and how they can use hemp, which is right now legal.”

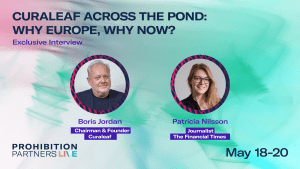

Curaleaf Across the Pond: Why Europe, Why Now? At 2.30pm on the Cannabis Europa stage, saw the firm’s executive chairman and founder, Boris Jordan, in a live discussion with Financial Times reporter, Patricia Nilsson.

Asked by Ms Nilsson why Curaleaf had moved into the European market with its acquisition of EMMAC, Mr Jordan said: “Very similarly to the way we approached the US market, we were early arrivals. We started buying companies across the United States back in 2014, 2015, 2016 onwards, and the reason we did was we felt that you can’t build either national or global brands unless you have the distribution capability and the manufacturing capability in those markets…getting in early gives you 1) a head start on the development and knowledge of the market, and 2) it also gets you in early before the prices go up.”

With the European and US markets expected to be worth $200bn he added that it was too big an opportunity to be ignored “and we want to be the largest player in the world, and we are now, and we want to maintain that position.”

Asked if he thought more North American companies would be investing in the European market, he said: “I think that eventually they will come once the programme is bigger. A lot of the US companies are capital constrained, but more importantly, because capital you can find, they don’t know Europe very well.”

Over on the Cannabis Americana stage Fail Better: What Important Lessons Can We Learn From Those Who’ve Been There Before? saw moderator Tiffany Kary (a reporter with Bloomberg News), Nick Tennant (founder and chief technical officer of Precision Extract Solutions), and Cy Scott (co-founder and CEO of Headset), delve into the wins and losses of those who have taken risks and overcome adversity.

Mr Scott said there were many risks that are unique to the cannabis industry. “Cannabis has some incredible tailwinds built into the space. I have personally been involved in cannabis since 2010 and the world has changed quite a bit….you are seeing more and more markets legalised, international markets coming online…it’s fantastic for growth, it’s fantastic for businesses like ours…but there is fragmentation, there is legislative challenges, so with those tailwinds you certainly have a lot of headwinds.”

Mr Tennant added: “One of the biggest threats, and it always has been, is the regulatory environment. We have to understand that we live in this quasi-regulated environment right now in cannabis.

“When we compare our industry relative to something like supplement manufacturing, there is good manufacturing practice standards in supplement manufacturing, there is good agricultural practice standards, and ultimately these standards are going to find there way into cannabis.

“And what that means is when we get a Federal legalisation or a Federal de-scheduling, the FDA will start sinking its claws into how cannabis is grown, how it’s produced, and how it’s traceable, and ultimately it’s the right thing to do, but it’s going to be a substantial regulatory hurdle for a lot of these companies as they are just not set up for this type of infrastructure.”

The Investors Circle: Which Companies Are Set to Light Up the Market? got underway on the ProCapital platform at 4pm with moderator Sam Volkering (editor and investment director at Southbank Investment Research) leading expert analysts and investors Thomas Carroll (senior analyst at Stransberry Research) and Matt Karnes (founder GreenWave Advisors LLC) through the current scene.

Mr Karnes said what excites him about the explosion in the cannabis market is “the growth prospects, and that the legitimacy of the industry that we (his firm) outlined in 2014 is now starting to come to fruition. We are at an inflexion point and it’s really exciting right now.”

Mr Carroll said: “This is the biggest new market of our generation…my personal belief is we are going to see the medical aspect of cannabis far outstrip the opportunities in its use as a recreational substance, like alcohol or cigars.

“Is Federal legalisation really a corner stone launching this industry? I think absolutely not. Certainly it’s a good thing, but if you look around cannabis is getting legalised all around us…if you wait to get involved until the President, either this one or the next one, puts pen to paper and signs some type of meaningful legislation, as an investor you are way, way, way behind the boat.”

With Canada and the US the two big investor markets, Mr Karnes said: “I favour the US MSOs over the Canadian LPs, and the primary reason is over supply and… just the way some of these companies have been managed, and quarter after quarter they have been missing earnings, they have been bleeding cash.”

Another short networking break led into two back-to-back company presentations and interviews on the ProCapital platform hosted by Jay Rosenthal, co-founder and president of The Business of Cannabis.

The first at 5.10pm saw Toby Gordon-Smith, the CEO of UK-based CBD and botanical products firm, Grass and Co, delving deeper into his business, which is turning the heads of consumers with retail listings in Selfridges, Ocado, Amazon and from June, Holland and Barrett.

Mr Gordon-Smith said: “The exciting thing for us is that we have a direct to consumer business that has been growing and growing pretty well through the covid era with strong online growth, but on top of that we have these great national account relationships.

“Holland and Barrett is the UK’s number one CBD retailer at the moment, so it’s a really exciting step-up for us and the brand and takes this business to a new dimension in terms of previous investment rounds.

“We are now in a position where we have proven the idea is real, and these retail relationships really help us to become an established business and for the story to be much more about scale-up rather than start-up investment.”

Asked who the company’s perfect investor would be, Mr Gordon-Smith said: “We are at the stage where we are talking about institutional investors, where previously it would have been high net worths and family offices…there are almost two buckets that would be attractive to us, someone coming in with a strong cannabis focus and maybe up-steam assets that can be very beneficial to us in the future, the other could be much more traditional, a FMCG (Fast Moving Consumer Goods) venture fund player, but for whom I think we present an exciting category growth story but also a very strong brand.”

At 5.40pm, Always Pure Organics took centre stage with CEO Gavin Ogilvie. Manchester-based APO started in 2018 and offers the highest quality wholesale legal cannabis and cannabidiol (CBD) merchandise, as bulk ingredients and products, white label, and bespoke formulations, coupled with regulatory and legal expertise.

Mr Ogilvie said: “We started the company, we didn’t have a great deal of money at the time, we knew that we wanted to be involved in the CBD, hemp and cannabis sector, we could see what was taking place over in North America, and we were pretty confident that we were going to see this transition, this shift, this green revolution, begin to take place in the UK quite soon.”

He explained that the company had been started with £400 and in that time had achieved £12m of turnover, with forecasted 2021 revenue of £15.1m, now employs 50 members of staff, has 500 clients, primarily in the UK and Europe, and had managed to do everything to date without raising any debt or selling equity in the company.

Asked what’s next for APO, Mr Ogilvie said: “We’re going to the moon! We have huge ambitions for not only APO but also the industry itself here in the UK, in Europe and in Japan, and we see ourselves as a real driving force and flag bearer for that.”

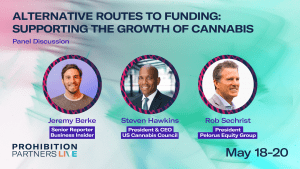

Back to the subject of investment, Alternative Routes to Funding at 6.10pm on the Cannabis Americana stage saw moderator Jeremy Berke (senior reporter at Insider Inc) quiz Steven Hawkins (president and CEO of the US Cannabis Council) and Rob Sechrist (president of Pelorus Equity Group) on America’s Cannabis SAFE Banking Act and how the sector can support the growth of the cannabis industry from start-up to MSO.

Mr Berke said the cannabis industry is booming and could rocket to £100bn in the US by 2030, with 91% of Americans saying it should be legal for both medical and recreational use. But cannabis does remain illegal at Federal level, and while there is movement on that front with the Cannabis SAFE Banking Act passing the US Congress for a second time earlier this year, start-ups and properly traded companies in the industry alike lack the traditional funding tools to do business.

Mr Hawkins said options to start and grow are limited and “that’s part of the problem. Unless you have your own private source of wealth, or can tap into an asset…those are the avenues, and perhaps a third, friends and family, but that only gets you so far.”

But he said the market was expanding and his advice to people was “To look at investment opportunities that make sense. I think there will be efforts around banking as well to try to expand what safe harbours there are for banks to be able to operate. We won’t get capital markets out of this, but hopefully we will be able to expand what has been on the table.”

Mr Sechrist added: “The institutional players out there, custodians, the pension funds, the insurance companies, we are talking to them and they are leaning in right now…it is moving along.”

But he added: “Nothing is changing with SAFE banking, The banks have to make that moral decision that they are going to go down that route. Unless you got the capital markets, there wasn’t a win. So, you have to get the capital markets on board here because that is what unleashes the most efficient capital markets in the world.”

Cannabis Americana hosted the final presentation of Prohibition Partners LIVE - The Rise and Rise of Celebrity Cannabis Brands: How Do Celebrity Backed Cannabis Companies Stay Authentic?

With more and more celebrity-backed companies and products entering the cannabis market, Javier Hasse (CEO and co-founder of El Planteo) and Steve Allan (chief executive of The Parent Company) explored how brands can maintain their integrity and avoid giving the impression of merely jumping on the bandwagon.

The Parent Company – which is backed by entertainment mogul Shawn ‘Jay-Z’ Carter - is one of the brands which is leveraging its celebrity deals and the fact that these icons aren’t just endorsers, but part of the company.

Mr Allan said: “The reality with Jay is that he really has an authenticity in cannabis and really has an appreciation and love for the plant. It was actually Jay who approached Caliva back in 2019. He had been looking at the opportunity within the cannabis market. He is not only a developer of brands, he is a tastemaker and a changemaker and he recognises that.”

From an investors perspective, Mr Allan said having a celebrity involved aligned perfectly. “Right now, the biggest issue in cannabis is awareness…and so these artistes, they really have the ability to elevate the conversation, to be able to raise the entire industry….and if you are driving that conversation then inevitably you become synonymous with cannabis…these celebrities have the ability to elevate that stature, to change the conversation.”

Prohibition Partners’ Stephen Murphy then officially brought the conference to a close at 7.30pm.

He thanked attendees, sponsors, speakers and the team at Prohibition Partners Live for giving up their time, their insights and knowledge over the three days and “for sharing so openly with us all.”